Webull Securities (Europe) B.V. ("WSEU"), is authorised and regulated by the Dutch Authority for the Financial Markets, the AFM (License No. 14006336), for the conduct of investment business and is registered by Dutch Central Bank (De Nederlandse Bank, “DNB”). WSEU is registered at the Dutch Chamber of Commerce under 87019175.

Market data, development, and operations of this website are provided by Webull Technologies Pte. Ltd. Webull and WSEU are separate entities under common ownership.

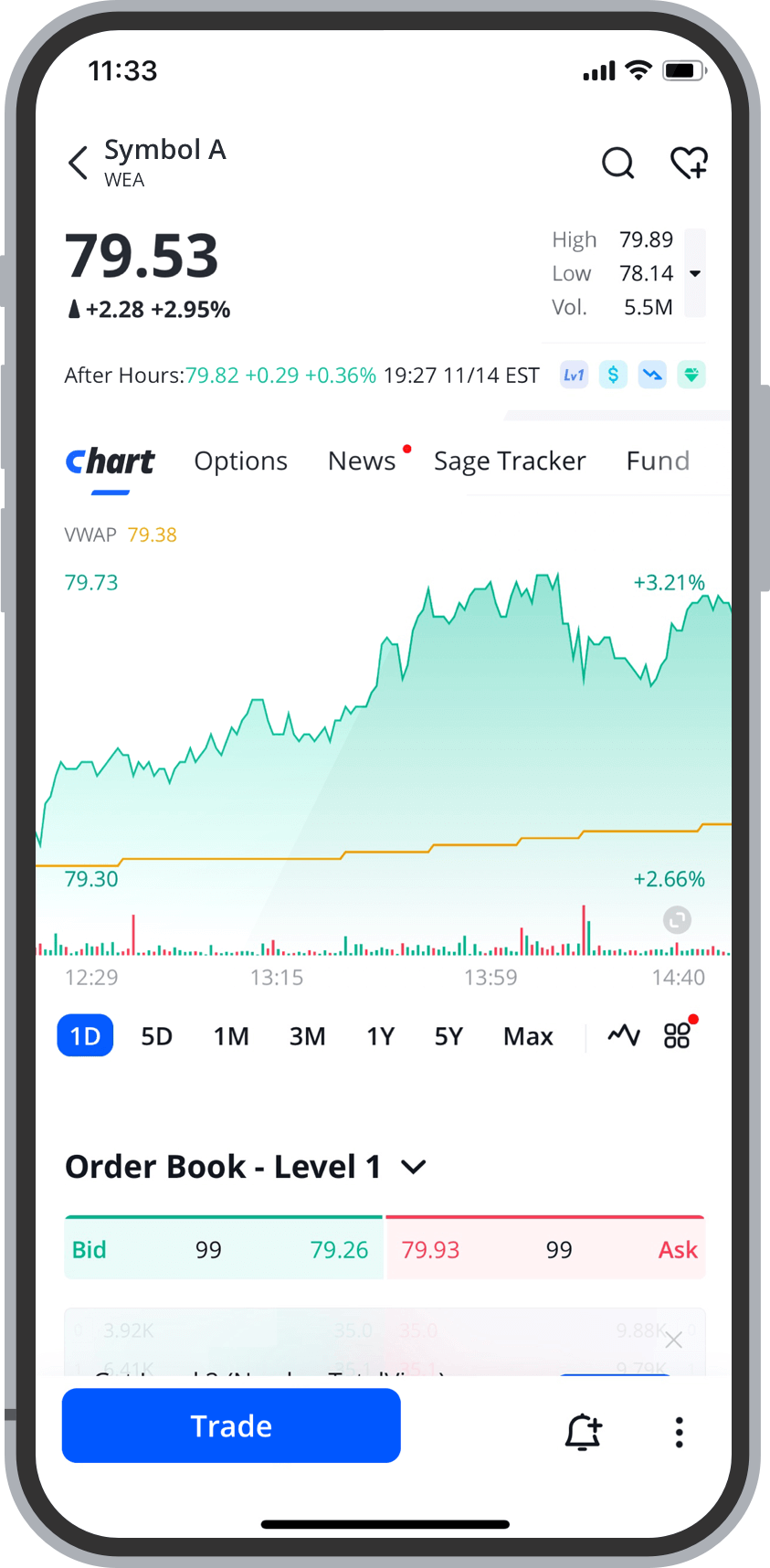

No content on this website or affiliated websites/applications should be considered a recommendation or solicitation for the purchase or sale of securities, derivatives, or any other financial products. All information and data contained in this website are for reference only, and no historical data should be considered as the basis for predicting future trading trends. Investors should be aware that system responses, execution price, speed, liquidity, market data, and account access times may be affected by many factors, including market volatility, size and type of order, market conditions, system performance and other factors. The information provided is for informational purposes only unless otherwise stated. Distribution of investment products to, or services offered to, any person is not intended in any jurisdiction where such distribution or use would contravene prevailing laws or regulations. Services are only intended for persons in jurisdictions or countries where it is legal for such persons to receive them.

Copyright © 2026 Webull Securities (Europe) B.V. All Rights Reserved.